Depreciation percentage on equipment

Balance Asset Value - Depreciation Value. Depreciation starts when the asset is in the location and condition necessary for it to be capable of operating in the manner intended by management.

What Is Equipment Depreciation And How To Calculate It

Depreciation Office equipment carrying value Office equipment salvage value Useful life x 2 Example A company Blue Co acquires computers for office use which.

. Depreciation per year Book value Depreciation rate. This is the same moment. 170 rows Except for assets in respect of which no extra shift depreciation is permitted indicated by NESD in Part C above if an asset is used for any time during the year for double shift the.

The MACRS schedule for. Hence the depreciation expense for 2018 was 8500-500 15 1200. Methods of depreciation as per Income Tax Act 1961 Based on Specified Rates.

1 Depreciation expense for 2019. If a taxpayer claims 100 percent bonus depreciation the greatest allowable depreciation deduction is. This assumption effectively provides an additional year of the depreciation deduction.

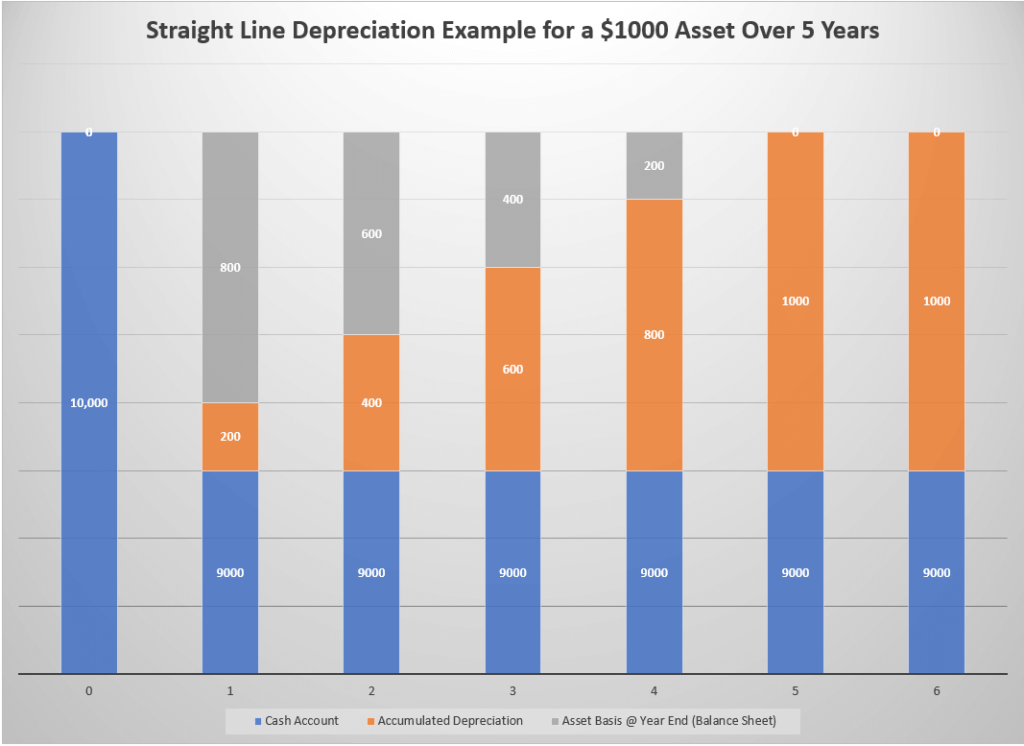

Depreciation Amount Asset Value x Annual Percentage. 8000 20. The calculator uses the following formulae.

Class 8 20 Class 8 with a CCA rate of 20 includes certain property that is not included in another class. Not Book Value Scrap value Depreciation rate. Table A-4 below provides percentages to calculate the annual depreciation over a propertys class life to recover the cost of 3- 5- 7- 10- 15- and 20-year property using 150.

18000 for the first year 16000 for the second year 9600 for the third year. Where NBV is costs less accumulated depreciation. So if the straight-line depreciation rate is calculated to be 10 percent the 150 percent depreciation is found by dividing the straight-line depreciation percentage by 15 150.

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Written Down Value Method Block wise Straight Line Method for Power Generating Units. Examples are furniture appliances and tools costing 500 or more.

10000 20 2000 The NBV is 10000 because cost less accumulated depreciation 10000 0 2 Depreciation expense for 2020. You may also be interested in our Car. Medical equipments useful life is assessed at five years.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Property Plant Equipment Components Depreciation Methods Service Life

Accumulated Depreciation Definition Formula Calculation

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

What Is Equipment Depreciation And How To Calculate It

Depreciation Rate Formula Examples How To Calculate

Accelerated Depreciation And Machinery Purchases Center For Commercial Agriculture

Depreciation Nonprofit Accounting Basics

Depreciation Rate Formula Examples How To Calculate

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Rate For Plant Furniture And Machinery

Depreciation Schedule Formula And Calculator Excel Template

How To Calculate Depreciation Expense

Depreciation On Equipment Definition Calculation Examples

Depreciation Formula Calculate Depreciation Expense

Depreciation Nonprofit Accounting Basics