Gross pay hourly calculator

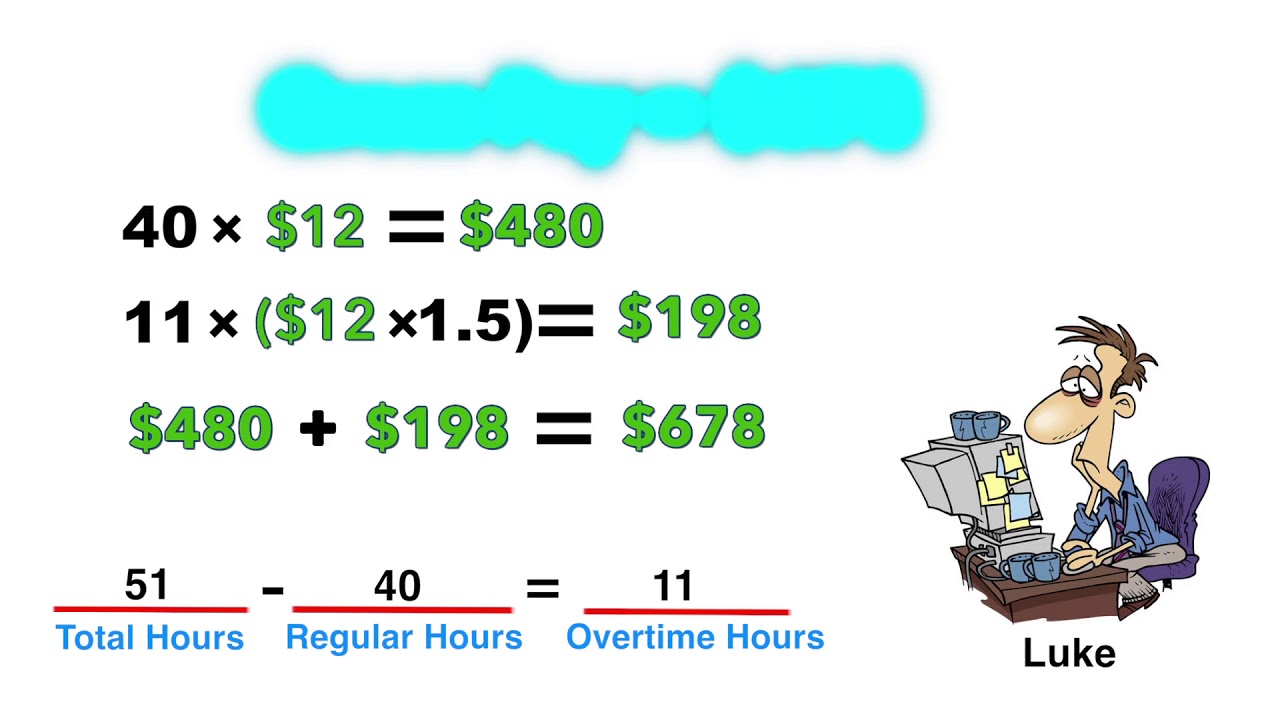

Hourly non-exempt employees must be paid time and a half for hours worked beyond 40 hours in a workweekIssuing comp time in place of overtime pay is not allowed for non-exempt employees. It determines the amount of gross wages before taxes and deductions that are withheld given a specific.

Annual Salary Calculator Best Sale 51 Off Www Wtashows Com

Enter the pay before the raise into the calculator.

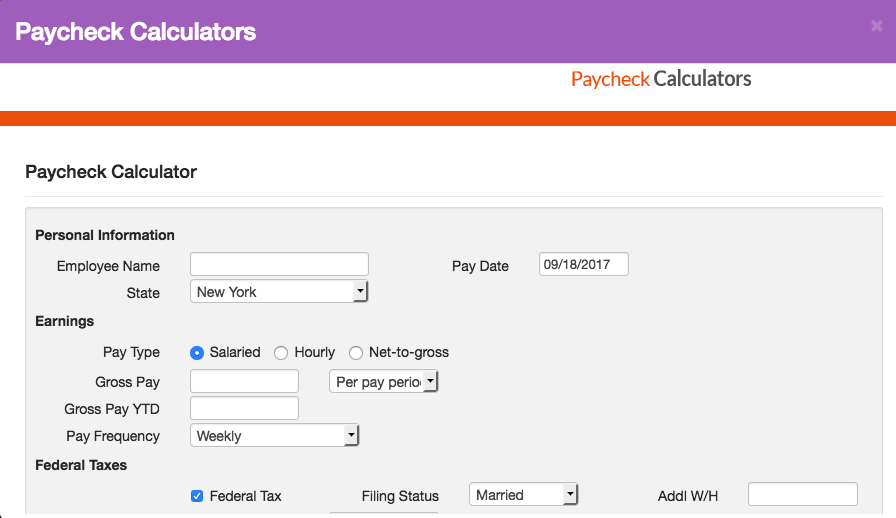

. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This is where the deductions begin. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made.

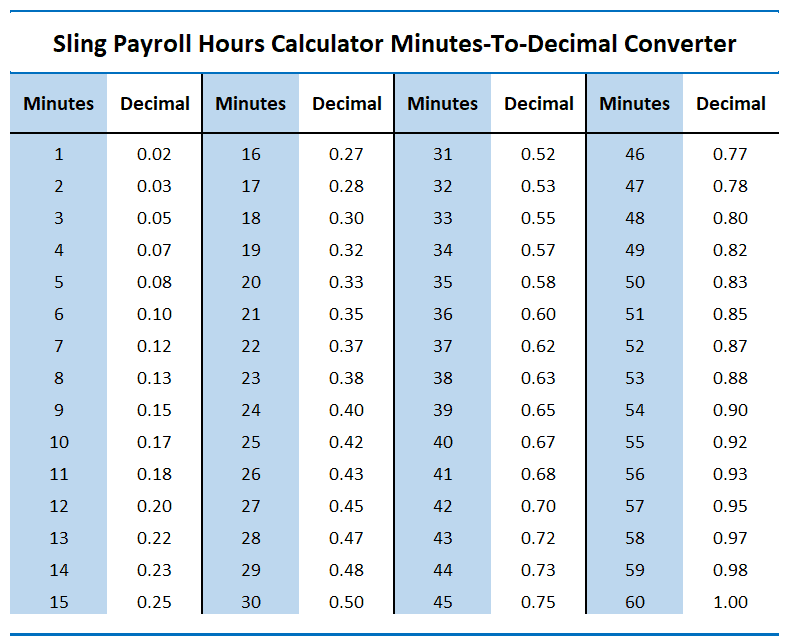

For example if you earn 2000week your annual. Net weekly income Hours of work per week Net hourly wage. Employers must provide an employee with 24 hours written notice before a wage change.

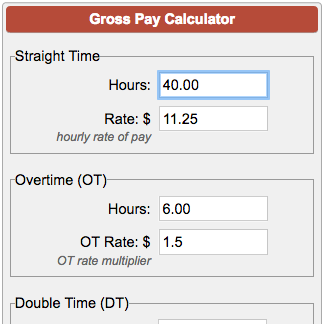

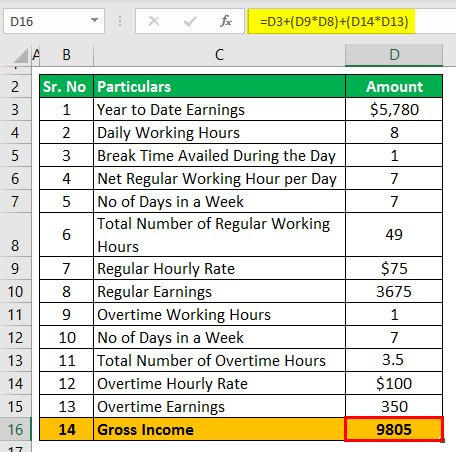

Net salary calculator from annual gross income in Ontario 2022. Hourly rate calculated from annual salary How do I calculate my take-home pay after income taxes. If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours.

Once you fill in one of those fields the pay raise calculator will output all. NHS Hourly Pay 202223 including NI The table below lists the NHS Band salary gross and net hourly rates amount per hour. Gross annual income - Taxes - CPP - EI Net annual salary.

This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis. If you already know your gross pay you can enter it directly into the Gross pay entry field. Hourly Rate Bi-Weekly Gross HoursYear Calculating Premium Rates.

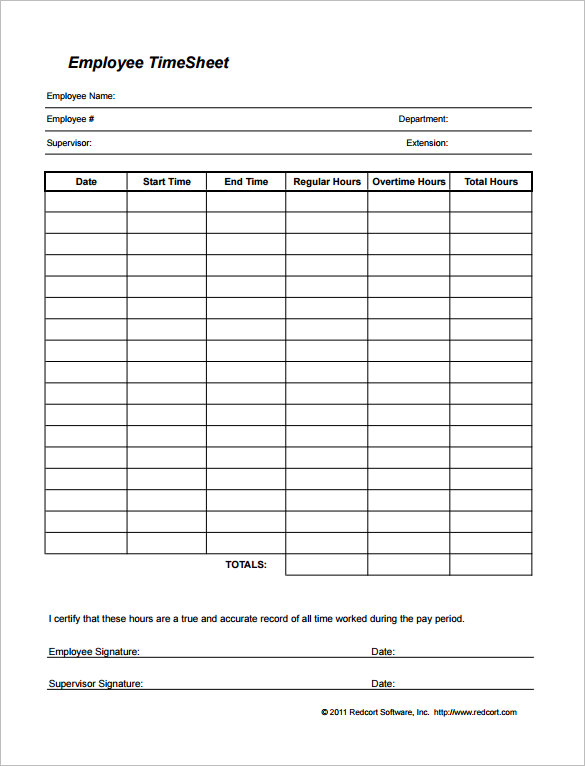

Then use the employees Form W-4 to fill in their state and. An hourly or nonexempt employee is paid by the hours worked times the agreed-upon hourly. 27 overtime pay rate x three hours paid incorrectly 81 gross retro pay due.

Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. For premium rate Time and One-Half multiply your hourly rate by 15. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Please note that these calculations are based on the 202223 NHS payrise announced in July 2022. In this case well use the hourly employee from Table 1 whose gross pay for the week was 695. Employers are required provided certain conditions are.

Input additional payments like overtime bonuses or commissions. Start with the employees gross pay. Hourly Paycheck Calculator quickly generates hourly net pay also called take-home pay free for every pay period for hourly employees.

Your gross pay will be automatically computed as you key in your entries. If you earn 27000 a year then after your taxes and national insurance you will take home 22202 a year or 1850 per month as a net salary. Depending on the information you provide the Pay Rate Calculator computes different information.

Other gross pay contributors. Net annual salary Weeks of work per year Net weekly income. Calculations have been updated to reflect the additional 202223 National Insurance contributions and changes in Pension contributions from October.

Prior Period Hourly Pay Rate Expected. Based on a 40 hours work-week your hourly rate will be 1068 with your 27000 salary. Use this federal gross pay calculator to gross up wages based on net pay.

Skip To The Main Content. You can choose whichever form is most convenient for you be it the hourly weekly monthly or annual rate and the rest will be converted automatically. Start by subtracting any pre-tax deductions offered by the business.

Enter the raise percentage raise amount or new pay. This calculator is based on 2022 Ontario taxes. To try it out enter the workers details in the payroll calculator and select the hourly pay rate option.

If this employee had zero deductions their gross pay and net pay would be the same. Then enter the number of hours worked and the employees hourly rate. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Fill the weeks and hours sections as desired to get your personnal net income. To calculate your net salary you will need to subtract federal and local income taxes as well as other deductions. The salary numbers on this page assume a gross or before tax salary.

For instance for Hourly Rate 2600 the Premium Rate at Time and One. Retro Pay Calculator - Hourly. You can use our simple calculator below to quickly calculate retroactive pay for hourly employees salaried employees and even for flat rate amounts.

To determine net pay gross pay is computed based on how an employee is classified by the organization. This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2022.

Hours Pay Calculator Cheap Sale 52 Off Www Wtashows Com

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly To Salary What Is My Annual Income

Gross Pay And Net Pay What S The Difference Paycheckcity

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Calculating Income Hourly Wage Youtube

Paycheck Calculator Apo Bookkeeping

Free Online Paycheck Calculator Calculate Take Home Pay 2022

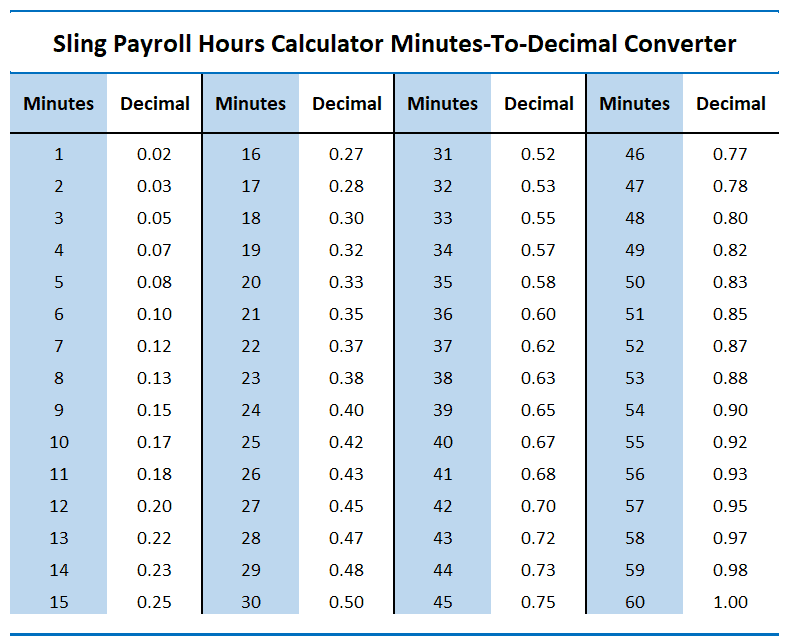

How To Calculate Payroll For Hourly Employees Sling

Salary To Hourly Calculator Hot Sale 52 Off Www Wtashows Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Hot Sale 51 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Calculate Gross Pay Youtube

Gross Pay And Net Pay What S The Difference Paycheckcity

Salary To Hourly Salary Converter Salary Hour Calculators